Multiple Choice

TABLE 15.1

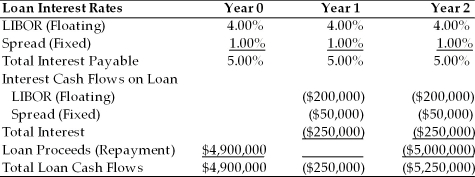

Use the information for Polaris Corporation to answer following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer Table 15.1. If the LIBOR rate falls to 3.00% after the first year what will be the all-in-cost (i.e. the internal rate of return) for Polaris for the entire loan?

A) 4.00%

B) 4.50%

C) 5.25%

D) 5.60%

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The financial manager of a firm has

Q20: Instruction 15.1:<br>For following problem(s), consider these debt

Q22: TABLE 15.2<br>Use the information to answer following

Q24: Graham Investments must pay floating rate interest

Q25: Some of the world's largest and most

Q28: Instruction 15.1:<br>For following problem(s), consider these debt

Q29: Instruction 15.1:<br>For following problem(s), consider these debt

Q30: A swap agreement may involve currencies or

Q42: Which of the following would be considered

Q42: The interest rate swap strategy of a