Multiple Choice

TABLE 15.2

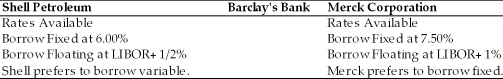

Use the information to answer following question(s) .

-Refer to Table 15.2. For a swap agreement structured by Barclay's to benefit both Shell and Merck, which of the following must be true?

A) Barclay's must be willing to lend to Merck at a fixed rate of less than 7.50% and to Shell at a variable rate of less than LIBOR + 1/2%.

B) Barclay's must be willing to lend to Shell at a fixed rate of less than 8.00% and to Merck at a variable rate of less than LIBOR + 1/2%.

C) Barclay's must be willing to lend to Merck at a variable rate of less than 8.00% and to Shell at a fixed rate of less than LIBOR + 1/2%.

D) Barclay's must be willing to lend to Merck at a fixed rate of greater than 8.00% and to Shell at a variable rate of greater than LIBOR + 1/2%.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: _ is the possibility that the borrower's

Q18: Cross currency swaps typically have larger swings

Q20: Instruction 15.1:<br>For following problem(s), consider these debt

Q24: Graham Investments must pay floating rate interest

Q25: Some of the world's largest and most

Q25: TABLE 15.1<br>Use the information for Polaris Corporation

Q30: A swap agreement may involve currencies or

Q42: Which of the following would be considered

Q42: The interest rate swap strategy of a

Q47: Which of the following would an MNE