Multiple Choice

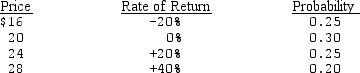

Phoenix Company common stock is currently selling for $20 per share. Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now:

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the expected rate of return on Phoenix Stock.

A) 8%

B) 0%

C) 10%

D) 40%

Correct Answer:

Verified

Correct Answer:

Verified

Q22: The risk premium for an individual security

Q27: The _ correlated the returns from two

Q37: Don has $3,000 invested in AT&T with

Q41: How can standard deviation, a statistical measure

Q51: Phoenix Company common stock is currently selling

Q82: The security returns from multinational companies tend

Q90: The return expected from a risky investment

Q96: The two elements that make up the

Q105: AKA's stock is currently selling for $11.44.This

Q111: That portion of the risk premium that