Multiple Choice

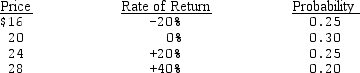

Phoenix Company common stock is currently selling for $20 per share. Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now:

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the standard deviation of possible rates of return on Phoenix stock (to the nearest tenth of a percent) .

A) 456%

B) 20.9%

C) 2.2%

D) 21.4%

Correct Answer:

Verified

Correct Answer:

Verified

Q21: An investor plans to invest 75 percent

Q22: The risk premium for an individual security

Q37: Don has $3,000 invested in AT&T with

Q53: Phoenix Company common stock is currently selling

Q82: The security returns from multinational companies tend

Q90: The return expected from a risky investment

Q96: The two elements that make up the

Q105: AKA's stock is currently selling for $11.44.This

Q111: That portion of the risk premium that

Q116: Business risk is influenced by all the