Essay

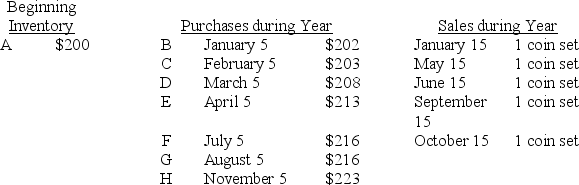

The following company purchases and sells collectors' coin sets.The company uses the LIFO inventory costing method.In the first two sections of the table below,each coin set is identified by its letter and its cost.The third section indicates when coin sets were sold.

Required:

For each inventory costing method given below,fill in the blanks to indicate the letter of the coin set which will be used to calculate either cost of goods sold or the cost of ending inventory.

Part a.Periodic Inventory System

Cost of Goods Sold = _____ + _____ + _____ + _____ + _____

Ending Inventory = _____ + _____ + _____

Part b.Perpetual Inventory System

Cost of Goods Sold = _____ + _____ + _____ + _____ + _____

Ending Inventory = _____ + _____ + _____

Correct Answer:

Verified

Part A - Periodic Inventory System

Cost ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Cost ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: Inventory shipped FOB shipping point and in

Q54: It is more useful to compare a

Q83: If inventory costs have been falling during

Q97: Which of the following would be considered

Q99: Which inventory costing method assumes that inventory

Q188: Eaton Electronics uses a periodic inventory system.On

Q195: A company can use LIFO to prepare

Q196: A company uses a weighted-average perpetual inventory

Q197: Alpha Company uses a periodic inventory system.The

Q208: LIFO and weighted average results will be