Essay

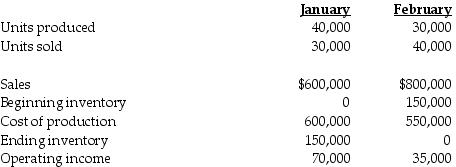

The manager of the manufacturing division of Iowa Windows does not understand why income went down when sales went up. Some of the information he has selected for evaluation include:

The division operated at normal capacity during January.

Variable manufacturing cost per unit was $5, and the fixed costs were $400,000.

Selling and administrative expenses were all fixed.

Required:

Explain the profit differences. How would variable costing income statements help the manager understand the division's operating income?

Correct Answer:

Verified

The 10,000 units in inventory being assi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q165: The following information pertains to Stone Wall

Q166: Ms. Sophia Jones, the company president, has

Q167: Under absorption costing, managers can increase operating

Q168: The following data are available for Brennan

Q169: The contribution-margin format is used for _.<br>A)

Q171: Swansea Finishing produces and sells a decorative

Q172: The basis of the difference between variable

Q173: If 1,000 units are produced and only

Q174: Jupiter Corporation incurred fixed manufacturing costs of

Q175: _ is a method of inventory costing