Multiple Choice

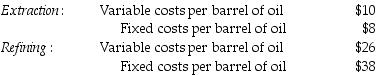

Axelia Corporation has two divisions, Refining and Extraction. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,300 barrels a day and usually purchases 25,400 barrels of oil from the Extraction Division and 15,100 barrels from other suppliers at $64 per barrel.

What is the transfer price per barrel from the Extraction Division to the Refining Division, assuming the method used to place a value on each barrel of oil is 120% of full costs?

A) $18.00

B) $21.60

C) $56.00

D) $100.80

Correct Answer:

Verified

Correct Answer:

Verified

Q1: One advantage of prorating the difference between

Q2: Briefly describe the conditions that should be

Q3: A company has a plant in a

Q5: Incongruent decision making occurs when individuals and

Q6: DesMoines Valley Company has two divisions, Computer

Q7: Olive Branch Company recently acquired an olive

Q8: Which of the following is a disadvantage

Q9: A benefit of using a market-based transfer

Q10: Management control systems utilize information gathered within

Q11: For each of the following Balanced Scorecard