Essay

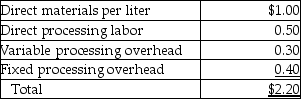

Olive Branch Company recently acquired an olive oil processing company that has an annual capacity of 2,000,000 liters and that processed and sold 1,400,000 liters last year at a market price of $4 per liter. The purpose of the acquisition was to furnish oil for the Cooking Division. The Cooking Division needs 800,000 liters of oil per year. It has been purchasing oil from suppliers at the market price. Production costs at capacity of the olive oil company, now a division, are as follows:

Management is trying to decide what transfer price to use for sales from the newly acquired company to the Cooking Division. The manager of the Olive Oil Division argues that $4, the market price, is appropriate. The manager of the Cooking Division argues that the cost of $2.14 should be used, or perhaps a lower price, since fixed overhead cost should be recomputed with the larger volume. Any output of the Olive Oil Division not sold to the Cooking Division can be sold to outsiders for $4 per liter.

Required:

a.Compute the operating income for the Olive Oil Division using a transfer price of $4.

b.Compute the operating income for the Olive Oil Division using a transfer price of $2.20.

c.What transfer price(s) do you recommend? Compute the operating income for the Olive Oil Division using your recommendation.

Correct Answer:

Verified

a.

b.

c.Due to current demand in e...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.

c.Due to current demand in e...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Briefly describe the conditions that should be

Q3: A company has a plant in a

Q4: Axelia Corporation has two divisions, Refining and

Q5: Incongruent decision making occurs when individuals and

Q6: DesMoines Valley Company has two divisions, Computer

Q8: Which of the following is a disadvantage

Q9: A benefit of using a market-based transfer

Q10: Management control systems utilize information gathered within

Q11: For each of the following Balanced Scorecard

Q12: Which of the following taxes does transfer