Multiple Choice

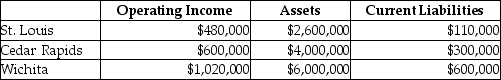

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5,200,000 issued at an interest rate of 13%, and equity capital that has a market value of $4,200,000 (book value of $2,400,000) . Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 13%, while the tax rate is 35%.

What is the EVA® for St. Louis? (Round intermediary calculations to four decimal places.)

A) $65,739

B) $51,048

C) $312,000

D) $260,952

Correct Answer:

Verified

Correct Answer:

Verified

Q71: Batman Abstract Company has three divisions that

Q72: Megatron Corp. earned net income of 16,000

Q73: Care Inc., has two divisions that operate

Q74: Aaron Corp's net income is $25,000. What

Q75: Assume you are evaluating a manufacturing company.

Q77: The top management at Groundsource Company, a

Q78: Stock options give executives the right to

Q79: The return on investment is usually considered

Q80: Historical-cost-based accounting measures are usually inadequate for

Q81: Which of the following is the expression