Multiple Choice

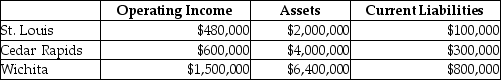

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5,400,000 issued at an interest rate of 12%, and equity capital that has a market value of $4,300,000 (book value of $2,100,000) . Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 35%.

What is the EVA® for Wichita? (Round intermediary calculations to four decimal places.)

A) $975,000

B) $959,040

C) $434,040

D) $356,760

Correct Answer:

Verified

Correct Answer:

Verified

Q55: Which of the following is true of

Q56: The Cybertronics Corporation reported the following information

Q57: Carriage Incorporated manufactures horse carriages. The company

Q58: The DuPont method recognizes the two basic

Q59: Home Decor Inc., manufactures home cleaning products.

Q61: To convert the operating income for an

Q62: Using residual income as a measure of

Q63: Current cost return on investment is a

Q64: Total assets employed includes all assets, regardless

Q65: A report that measures financial and nonfinancial