Multiple Choice

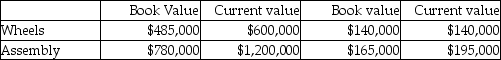

Carriage Incorporated manufactures horse carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2018:

ASSETSINCOME

The company is currently using a 12% required rate of return.

What are Wheels's and Assembly's residual incomes based on book values, respectively?

A) $71,400; $81,800

B) $81,800; $71,400

C) $68,000; $51,000

D) $51,000; $68,000

Correct Answer:

Verified

Correct Answer:

Verified

Q52: A company which favors the residual income

Q53: Bouvous Corp has two regional offices. The

Q54: To evaluate overall performance, return on investment

Q55: Which of the following is true of

Q56: The Cybertronics Corporation reported the following information

Q58: The DuPont method recognizes the two basic

Q59: Home Decor Inc., manufactures home cleaning products.

Q60: Waldorf Company has two sources of funds:

Q61: To convert the operating income for an

Q62: Using residual income as a measure of