Multiple Choice

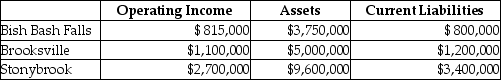

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $17,000,000 issued at an interest rate of 11%, and equity capital that has a market value of $6,000,000 (book value of $5,500,000) . Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 35%.

What is the EVA® for Stonybrook? (Round intermediary calculations to four decimal places.)

A) $1,184,600

B) $1,755,000

C) $570,400

D) $658,693

Correct Answer:

Verified

Correct Answer:

Verified

Q137: Intrinsic motivation comes from being given greater

Q138: What targets should companies use, and when

Q139: The top management at Groundsource Company, a

Q140: Capital Investments has three divisions. Each division's

Q141: Return on investment can be calculated by

Q143: Reducing the investment base to improve ROI

Q144: An excessive focus on diagnostic control systems

Q145: Which of the following best describes an

Q146: Craylon Corp. is planning the 2018 operating

Q147: Which of the following is the required