Essay

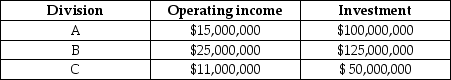

Capital Investments has three divisions. Each division's required rate of return is 15%. Planned operating results for 2015 are as follows:

The company is planning an expansion, which will require each division to increase its investments by $25,000,000 and its income by $4,500,000.

Required:

a.Compute the current ROI for each division.

b.Compute the current residual income for each division.

c.Rank the divisions according to their current ROIs and residual incomes.

d.Determine the effects after adding the new project to each division's ROI and residual income.

e.Assuming the managers are evaluated on either ROI or residual income, which divisions are pleased with the expansion and which ones are unhappy?

Correct Answer:

Verified

Only the manager of Division A is pleas...

Only the manager of Division A is pleas...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q135: Which of the following steps in designing

Q136: Carriage Incorporated manufactures horse carriages. The company

Q137: Intrinsic motivation comes from being given greater

Q138: What targets should companies use, and when

Q139: The top management at Groundsource Company, a

Q141: Return on investment can be calculated by

Q142: Coldbrook Company has two sources of funds:

Q143: Reducing the investment base to improve ROI

Q144: An excessive focus on diagnostic control systems

Q145: Which of the following best describes an