Multiple Choice

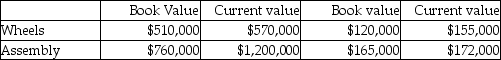

Carriage Incorporated manufactures horse carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2018:

ASSETSINCOME

The company is currently using a 14% required rate of return.

What are Wheels's and Assembly's return on investment based on current values, respectively?

A) 14%; 27%

B) 24%; 22%

C) 22%; 24%

D) 27%; 14%

Correct Answer:

Verified

Correct Answer:

Verified

Q131: Care Inc., has two divisions that operate

Q132: In an EVA calculation, the measure of

Q133: Which of the following best describes a

Q134: There should be strict congruence between the

Q135: Which of the following steps in designing

Q137: Intrinsic motivation comes from being given greater

Q138: What targets should companies use, and when

Q139: The top management at Groundsource Company, a

Q140: Capital Investments has three divisions. Each division's

Q141: Return on investment can be calculated by