Essay

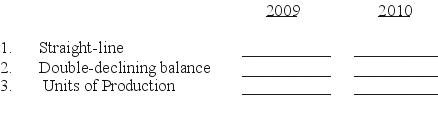

Calculate the depreciation for a $246,000 asset with a $10,000 salvage value that can produce 400,000 units over its 10-year life using the following methods.Assume the asset was purchased Oct 1 ,2009.During 2009 the asset produced 13,000 units and in 2010 it produced 28,000 units.How much depreciation expense will be recorded for 2009 and 2010.Write answers in the spaces below.YOU MUST SHOW YOUR WORK TO RECEIVE ANY CREDIT!

Correct Answer:

Verified

(1.)($246,000 - $10,000)/ 10 = $23,600 x...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: Healy Fabrication Corp wants to trade in

Q51: Match the following with the definitions and

Q52: Kenyon Company purchased land and a building

Q53: Which of the following would be classified

Q54: Which of the following is different for

Q56: Which of the following would be considered

Q57: Comptel Corporation purchased land,a building and equipment

Q58: Horizons,Inc.purchased a machine 3 years ago at

Q59: O'Conner Corporation purchased land with a building

Q60: Would a firm prefer straight-line or accelerated