Multiple Choice

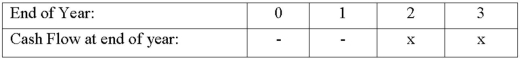

A bank purchases a 3-year, 6 percent $5 million cap (call options on interest rates) , where payments are paid or received at the end of year 2 and 3 as shown below:  Assume interest rates are 5 percent in year 2 and 7 percent in year 3. Which of the following is true?

Assume interest rates are 5 percent in year 2 and 7 percent in year 3. Which of the following is true?

A) The bank will receive $50,000 at the end of year 2 and receive $50,000 at the end of year 3.

B) The bank will receive $50,000 at the end of year 2 and pay $50,000 at the end of year 3.

C) The bank will receive $0 at the end of year 2 and pay $50,000 at the end of year 3.

D) The bank will receive $0 at the end of year 2 and receive $50,000 at the end of year 3.

E) The bank will receive $50,000 at the end of year 2 and pay $0 at the end of year 3.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Managing interest rate risk for less creditworthy

Q11: An FI would normally purchase a cap

Q12: The concept of pull-to-maturity reflects the increasing

Q20: CBOT catastrophe call spread options have variable

Q36: A bank purchases a 3-year, 6 percent

Q39: In April 2012, an FI bought a

Q54: What reflects the degree to which the

Q68: The outstanding number of put or call

Q76: An investment company has purchased $100 million

Q81: An FI manager purchases a zero-coupon bond