Multiple Choice

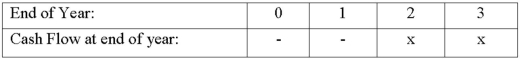

A bank purchases a 3-year, 6 percent $5 million cap (call options on interest rates) , where payments are paid or received at the end of year 2 and 3 as shown below:  In addition to purchasing the cap, if the bank also sells a 3-year 6 percent floor and interest rates are 5 percent and 7 percent in years 2 and 3, respectively, what are the payoffs to the bank? Specifically, the bank

In addition to purchasing the cap, if the bank also sells a 3-year 6 percent floor and interest rates are 5 percent and 7 percent in years 2 and 3, respectively, what are the payoffs to the bank? Specifically, the bank

A) receive $50,000 at the end of year 2 and receive $50,000 at the end of year 3.

B) pay $50,000 at the end of year 2 and receive $50,000 at the end of year 3.

C) receive $0 at the end of year 2 and pay $50,000 at the end of year 3.

D) receive $0 at the end of year 2 and $50,000 at the end of year 3.

E) receive $50,000 at the end of year 2 and pay $0 at the end of year 3.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Managing interest rate risk for less creditworthy

Q33: Most bond options trade on the over

Q39: In April 2012, an FI bought a

Q40: A bank purchases a 3-year, 6 percent

Q46: The buyer of a bond call option<br>A)receives

Q68: The outstanding number of put or call

Q76: An investment company has purchased $100 million

Q81: An FI manager purchases a zero-coupon bond

Q112: Allright Insurance has total assets of $140

Q113: The combination of being long in the