Multiple Choice

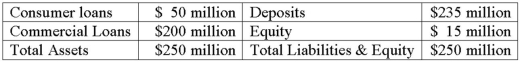

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the change in the value of the FI's equity for a 1 percent increase in interest rates from the current rates of 10 percent ?

What is the change in the value of the FI's equity for a 1 percent increase in interest rates from the current rates of 10 percent ?

A) -$,979,091.

B) -$16,318,182.

C) -$15,979,091.

D) +$16,318,182.

E) +$979,091.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Financial futures can be used by FIs

Q22: Futures contracts are standard in terms of

Q42: The sensitivity of the price of a

Q59: Which of the following is NOT true

Q94: Historical analysis of recent changes in exchange

Q113: The payoff on a catastrophe futures contract

Q118: An FI with a negative duration gap

Q149: What is a difference between a forward

Q170: Federal regulations in Canada allow derivatives to

Q175: The average duration of the loans is