Multiple Choice

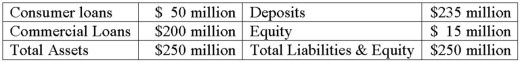

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value and if basis risk shows that for every 1 percent shock to interest rates, i.e., ΔR/(1 + R) = 0.01, the implied rate on the deliverable bonds in the futures market increases by 1.1 percent, i.e., ΔRf/(1 + Rf) = 0.011?

What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value and if basis risk shows that for every 1 percent shock to interest rates, i.e., ΔR/(1 + R) = 0.01, the implied rate on the deliverable bonds in the futures market increases by 1.1 percent, i.e., ΔRf/(1 + Rf) = 0.011?

A) 1,500 contracts.

B) 1,888 contracts.

C) 2,100 contracts.

D) 2,408 contracts.

E) 3,100 contracts.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Futures contracts are standard in terms of

Q24: An FI with a positive duration gap

Q34: Futures contracts are the primary security that

Q42: The sensitivity of the price of a

Q59: Which of the following is NOT true

Q94: Historical analysis of recent changes in exchange

Q109: The hedge ratio measures the impact that

Q113: The payoff on a catastrophe futures contract

Q170: Federal regulations in Canada allow derivatives to

Q172: The average duration of the loans is