Multiple Choice

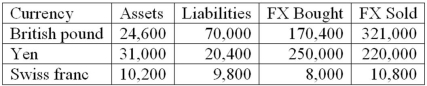

The following are the net currency positions of a Canadian FI (stated in Canadian dollars) .  What is the FI's net exposure in the Japanese yen?

What is the FI's net exposure in the Japanese yen?

A) +30,000.

B) +40,600.

C) -19,400.

D) -40,600.

E) +20,600.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q32: When purchasing and selling foreign currencies to

Q38: Violation of the interest rate parity theorem

Q44: Your U.S.bank issues a one-year U.S.CD at

Q52: A positive net exposure position in FX

Q54: Your U.S.bank issues a one-year U.S.CD at

Q68: Most nonbank FIs have foreign exchange risk

Q72: The following are the net currency positions

Q91: If foreign currency exchange rates are highly

Q97: On-balance-sheet hedging involves making changes in the

Q100: Most profits or losses on foreign trading