Multiple Choice

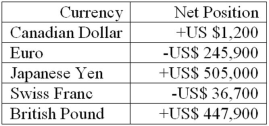

The following are the net currency positions of a U.S. FI (stated in U.S. dollars) . Note: Net currency positions are foreign exchange bought minus foreign exchange sold restated in U.S. dollar terms.  What is the portfolio weight of the Japanese yen in this FI's portfolio of foreign currency?

What is the portfolio weight of the Japanese yen in this FI's portfolio of foreign currency?

A) +0.18 percent.

B) -36.62 percent.

C) +75.20 percent.

D) -5.47 percent.

E) +66.70 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: When purchasing and selling foreign currencies to

Q38: Violation of the interest rate parity theorem

Q44: Your U.S.bank issues a one-year U.S.CD at

Q52: A positive net exposure position in FX

Q54: Your U.S.bank issues a one-year U.S.CD at

Q67: Which of the following FX trading activities

Q68: Most nonbank FIs have foreign exchange risk

Q73: The following are the net currency positions

Q97: On-balance-sheet hedging involves making changes in the

Q100: Most profits or losses on foreign trading