Multiple Choice

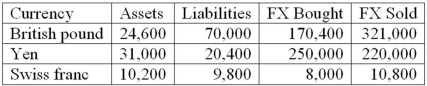

The following are the net currency positions of a Canadian FI (stated in Canadian dollars) .  How would you characterize the FI's risk exposure to fluctuations in the British pound to dollar exchange rate?

How would you characterize the FI's risk exposure to fluctuations in the British pound to dollar exchange rate?

A) The FI is net short in the British pound and therefore faces the risk that the British pound will rise in value against the U.S. dollar.

B) The FI is net short in the British pound and therefore faces the risk that the British pound will fall in value against the U.S. dollar.

C) The FI is net long in the British pound and therefore faces the risk that the British pound will fall in value against the U.S. dollar.

D) The FI is net long in the British pound and therefore faces the risk that the British pound will rise in value against the U.S. dollar.

E) The FI has a balanced position in the British pound.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Directly matching foreign asset and liability books

Q23: The use of an exchange rate forward

Q31: Off-balance-sheet hedging involves taking a position in

Q33: The market in which foreign currency is

Q38: Violation of the interest rate parity theorem

Q69: The decrease in European FX volatility during

Q80: The following are the net currency positions

Q88: An FI has purchased (borrowed) a one-year

Q91: If foreign currency exchange rates are highly

Q105: The total FX risk for a domestic