Multiple Choice

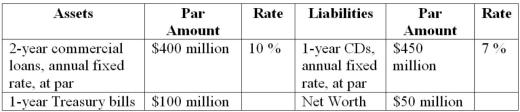

First Duration Bank has the following assets and liabilities on its balance sheet  What is the FI's interest rate risk exposure?

What is the FI's interest rate risk exposure?

A) Exposed to increasing rates.

B) Exposed to decreasing rates.

C) Perfectly balanced.

D) Exposed to long-term rate changes.

E) Insufficient information.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: As the investment horizon approaches, the duration

Q85: The following information is about current spot

Q86: The following information is about current spot

Q88: First Duration, a securities dealer, has a

Q92: Immunizing the balance sheet of an FI

Q95: The numbers provided are in millions of

Q110: Consider a one-year maturity, $100,000 face value

Q124: Calculate the duration of a two-year corporate

Q127: Duration of a zero coupon bond is

Q129: A bond is scheduled to mature in