Multiple Choice

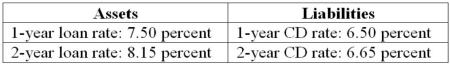

The following information is about current spot rates for Second Duration Savings' assets (loans) and liabilities (CDs) . All interest rates are fixed and paid annually.  What is the duration of the two-year loan (per $100 face value) if it is selling at par?

What is the duration of the two-year loan (per $100 face value) if it is selling at par?

A) 2.00 years

B) 1.92 years

C) 1.96 years

D) 1.00 year

E) 0.91 years

Correct Answer:

Verified

Correct Answer:

Verified

Q75: Larger coupon payments on a fixed-income asset

Q80: The duration of all floating rate debt

Q82: An FI purchases a $9.982 million pool

Q83: The numbers provided are in millions of

Q84: Consider a six-year maturity, $100,000 face value

Q86: The following information is about current spot

Q88: First Duration, a securities dealer, has a

Q90: First Duration Bank has the following assets

Q124: Calculate the duration of a two-year corporate

Q129: A bond is scheduled to mature in