Multiple Choice

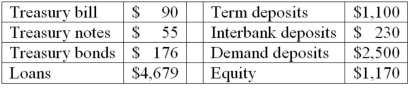

The numbers provided by Fourth Bank of Duration are in thousands of dollars.  Notes: All Treasury bills have six months until maturity. One-year Treasury notes are priced at par and have a coupon of 7 percent paid semiannually. Treasury bonds have an average duration of 4.5 years and the loan portfolio has a duration of 7 years. Term deposits have a 1-year duration and the Interbank deposits duration is 0.003 years. Fourth Bank of Duration assigns a duration of zero (0) to demand deposits. If the relative change in interest rates is a decrease of 1 percent, calculate the impact on the bank's market value of equity using the duration approximation.

Notes: All Treasury bills have six months until maturity. One-year Treasury notes are priced at par and have a coupon of 7 percent paid semiannually. Treasury bonds have an average duration of 4.5 years and the loan portfolio has a duration of 7 years. Term deposits have a 1-year duration and the Interbank deposits duration is 0.003 years. Fourth Bank of Duration assigns a duration of zero (0) to demand deposits. If the relative change in interest rates is a decrease of 1 percent, calculate the impact on the bank's market value of equity using the duration approximation.

(That is, ΔR/(1 + R) = -1 percent)

A) The bank's market value of equity increases by $325,550.

B) The bank's market value of equity decreases by $325,550.

C) The bank's market value of equity increases by $336,500.

D) The bank's market value of equity decreases by $336,500.

E) There is no change in the bank's market value of equity.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: In most countries FIs report their balance

Q20: Using a fixed-rate bond to immunize a

Q27: The difference between the changes in the

Q48: Deep discount bonds are semi-annual fixed-rate coupon

Q50: First Duration Bank has the following assets

Q51: The numbers provided are in millions of

Q52: The numbers provided by Fourth Bank of

Q55: The numbers provided are in millions of

Q66: A key assumption of Macaulay duration is

Q114: Attempts to satisfy the objectives of shareholders