Multiple Choice

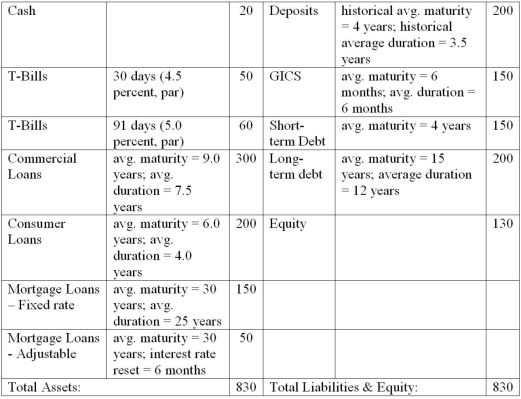

The numbers provided are in millions of dollars and reflect market values:  A risk manager could restructure assets and liabilities to reduce interest rate exposure for this example by

A risk manager could restructure assets and liabilities to reduce interest rate exposure for this example by

A) increasing the average duration of its assets to 9.56 years.

B) decreasing the average duration of its assets to 4.00 years.

C) increasing the average duration of its liabilities to 6.78 years.

D) increasing the average duration of its liabilities to 9.782 years.

E) increasing the leverage ratio, k, to 1.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: In most countries FIs report their balance

Q20: Using a fixed-rate bond to immunize a

Q27: The difference between the changes in the

Q48: Deep discount bonds are semi-annual fixed-rate coupon

Q50: First Duration Bank has the following assets

Q51: The numbers provided are in millions of

Q52: The numbers provided by Fourth Bank of

Q54: The numbers provided by Fourth Bank of

Q60: Third Duration Investments has the following assets

Q114: Attempts to satisfy the objectives of shareholders