Multiple Choice

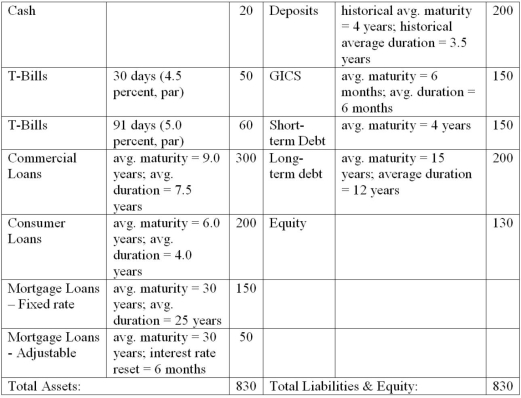

The numbers provided are in millions of dollars and reflect market values:  What is the leverage-adjusted duration gap of the FI?

What is the leverage-adjusted duration gap of the FI?

A) 3.61 years.

B) 3.74 years.

C) 4.01 years.

D) 4.26 years.

E) 4.51 years.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q12: An FI can immunize its portfolio by

Q20: Using a fixed-rate bond to immunize a

Q46: A bond is scheduled to mature in

Q48: Deep discount bonds are semi-annual fixed-rate coupon

Q60: Third Duration Investments has the following assets

Q63: The following is an FI's balance sheet

Q65: Consider a five-year, 8 percent annual coupon

Q97: Setting the duration of the assets higher

Q114: Attempts to satisfy the objectives of shareholders

Q123: When does "duration" become a less accurate