Multiple Choice

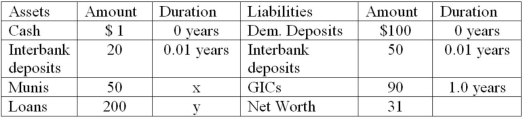

The following is an FI's balance sheet ($millions) .  Notes to Balance Sheet: Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. GICs are 1-year pure discount certificates of deposit paying 4.75 percent.

Notes to Balance Sheet: Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. GICs are 1-year pure discount certificates of deposit paying 4.75 percent.

What will be the impact, if any, on the market value of the bank's equity if all interest rates increase by 75 basis points?

A) The market value of equity will decrease by $15,750.

B) The market value of equity will increase by $15,750.

C) The market value of equity will decrease by $426,825.

D) The market value of equity will increase by $426,825.

E) There will be no impact on the market value of equity.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: The immunization of a portfolio against interest

Q12: An FI can immunize its portfolio by

Q20: Using a fixed-rate bond to immunize a

Q46: A bond is scheduled to mature in

Q48: Deep discount bonds are semi-annual fixed-rate coupon

Q60: Third Duration Investments has the following assets

Q62: The numbers provided are in millions of

Q65: Consider a five-year, 8 percent annual coupon

Q97: Setting the duration of the assets higher

Q123: When does "duration" become a less accurate