Multiple Choice

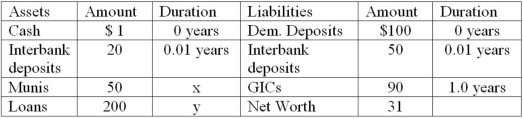

The following is an FI's balance sheet ($millions) .  Notes to Balance Sheet: Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. GICs are 1-year pure discount certificates of deposit paying 4.75 percent.

Notes to Balance Sheet: Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. GICs are 1-year pure discount certificates of deposit paying 4.75 percent.

What is the duration of the municipal notes (the value of x) ?

A) 1.94 years.

B) 2.00 years.

C) 1.00 years.

D) 1.81 years.

E) 0.97 years.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Managers can achieve the results of duration

Q29: In duration analysis, the times at which

Q75: Larger coupon payments on a fixed-income asset

Q77: Third Duration Investments has the following assets

Q80: The duration of all floating rate debt

Q82: An FI purchases a $9.982 million pool

Q83: Which of the following is indicated by

Q83: The numbers provided are in millions of

Q84: Consider a six-year maturity, $100,000 face value

Q87: Immunizing the net worth ratio requires that