Multiple Choice

The numbers provided are in millions of dollars and reflect market values:  The shortcomings of this strategy are the following except

The shortcomings of this strategy are the following except

A) duration changes as the time to maturity changes, making it difficult to maintain a continuous hedge.

B) estimation of duration is difficult for some accounts such as demand deposits and savings accounts.

C) it ignores convexity which can be distorting for large changes in interest rates.

D) it is difficult to compute market values for many assets and liabilities.

E) it does not assume a flat term structure, so its estimation is imprecise.

Correct Answer:

Verified

Correct Answer:

Verified

Q75: Larger coupon payments on a fixed-income asset

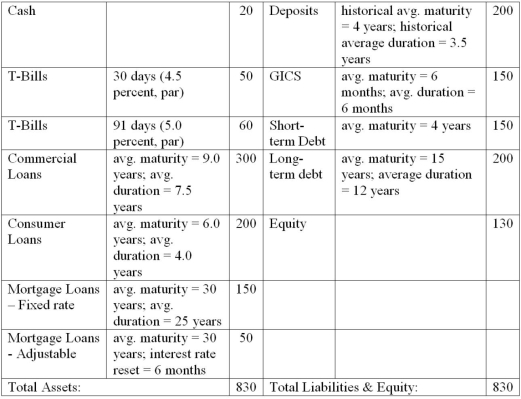

Q79: The following is an FI's balance sheet

Q80: The duration of all floating rate debt

Q82: An FI purchases a $9.982 million pool

Q84: Consider a six-year maturity, $100,000 face value

Q85: The following information is about current spot

Q86: The following information is about current spot

Q87: Immunizing the net worth ratio requires that

Q88: First Duration, a securities dealer, has a

Q129: A bond is scheduled to mature in