Multiple Choice

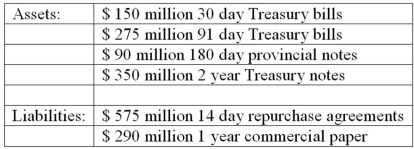

The following are the assets and liabilities of a government security dealer.  What is the impact over the next 30 days on the dealer's net interest income if all interest rates increase by 50 basis points?

What is the impact over the next 30 days on the dealer's net interest income if all interest rates increase by 50 basis points?

A) Net interest income will decrease by $50,000.

B) Net interest income will decrease by $2.125 million.

C) Net interest income will decrease by $475,000.

D) Net interest income will decrease by $2.375 million.

E) Net interest income will increase by $750,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: The repricing model is based on an

Q9: The gap ratio expresses the repricing gap

Q11: Duration Bank has the following assets and

Q17: The unbiased expectations theory of the term

Q18: One reason to exclude demand deposits when

Q44: When a bank's repricing gap is positive,

Q50: The maturity gap model estimates the difference

Q52: An interest rate increase<br>A)benefits the FI by

Q60: The cumulative repricing gap position of an

Q121: The repricing model ignores information regarding the