Multiple Choice

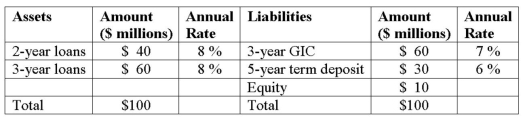

Duration Bank has the following assets and liabilities as of year-end. All assets and liabilities are currently priced at par and pay interest annually.  What is the change in the value of its assets if all interest rates decrease by 1 percent?

What is the change in the value of its assets if all interest rates decrease by 1 percent?

A) Approximately $1.613 million.

B) Approximately $2.297 million.

C) Approximately -$1.937 million.

D) Approximately $2.209 million.

E) Approximately $2.524 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: The repricing model is based on an

Q9: The gap ratio expresses the repricing gap

Q13: The following are the assets and liabilities

Q44: When a bank's repricing gap is positive,

Q50: The maturity gap model estimates the difference

Q51: A positive repricing gap implies that a

Q52: An interest rate increase<br>A)benefits the FI by

Q60: The cumulative repricing gap position of an

Q111: The repricing gap does not accurately measure

Q121: The repricing model ignores information regarding the