Multiple Choice

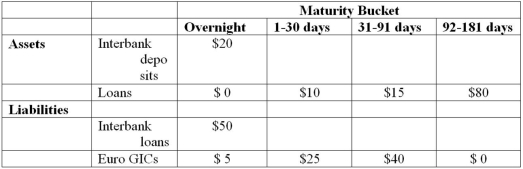

The following information details the current rate sensitivity report for Gotbucks Bank, Inc. ($million) .  What does Gotbucks Bank's 91-day gap positions reveal about the bank management's interest rate forecasts and the bank's interest rate risk exposure?

What does Gotbucks Bank's 91-day gap positions reveal about the bank management's interest rate forecasts and the bank's interest rate risk exposure?

A) The bank is exposed to interest rate decreases and positioned to gain when interest rates decline.

B) The bank is exposed to interest rate increases and positioned to gain when interest rates decline.

C) The bank is exposed to interest rate increases and positioned to gain when interest rates increase.

D) The bank is exposed to interest rate decreases and positioned to gain when interest rates increase.

E) Insufficient information.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: The market segmentation theory of the term

Q10: The change in economic value of a

Q29: Which of the following describes the condition

Q46: In general, the interest rate spread (spread

Q72: An FI's net interest income reflects<br>A)its asset-liability

Q73: The following information is from First Yaupon

Q74: Duration Bank has the following assets and

Q76: Duration Bank has the following assets and

Q79: Hadbucks National Bank current balance sheet appears

Q82: Hadbucks National Bank current balance sheet appears