Multiple Choice

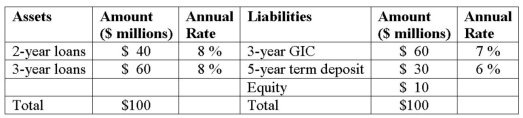

Duration Bank has the following assets and liabilities as of year-end. All assets and liabilities are currently priced at par and pay interest annually.  Is the bank exposed to interest rate increases or decreases and why?

Is the bank exposed to interest rate increases or decreases and why?

A) Interest rate increases because the value of its assets will rise more than its liabilities.

B) Interest rate increases because the value of its assets will fall more than its liabilities.

C) Interest rate decreases because the value of its assets will rise less than its liabilities.

D) Interest rate decreases because the value of its assets will fall more than its liabilities.

E) Interest rate increases because the value of its assets will fall less than its liabilities.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: The market segmentation theory of the term

Q46: In general, the interest rate spread (spread

Q69: Because of its complexity, small deposit-taking institutions

Q70: Which theory of term structure states that

Q71: The Bank for International Settlements (BIS) requires

Q72: An FI's net interest income reflects<br>A)its asset-liability

Q73: The following information is from First Yaupon

Q76: Duration Bank has the following assets and

Q77: The following information details the current rate

Q79: Hadbucks National Bank current balance sheet appears