Multiple Choice

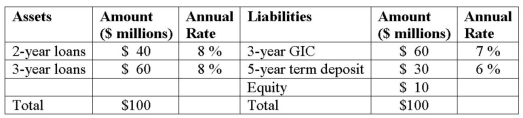

Duration Bank has the following assets and liabilities as of year-end. All assets and liabilities are currently priced at par and pay interest annually.  What is the weighted average maturity of the assets of the FI?

What is the weighted average maturity of the assets of the FI?

A) 2.0 years.

B) 2.3 years.

C) 2.5 years.

D) 2.6 years.

E) 3.0 years.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The market value of a fixed-rate liability

Q17: The maturity of a portfolio of assets

Q20: An FI finances a $250,000 2-year fixed-rate

Q32: When repricing all interest-sensitive assets and all

Q53: The term structure of interest rates assumes

Q54: Duration Bank has the following assets and

Q55: The following is the balance sheet of

Q57: A bank with a negative repricing (or

Q58: The average maturity of the liabilities of

Q61: Which theory of term structure posits that