Multiple Choice

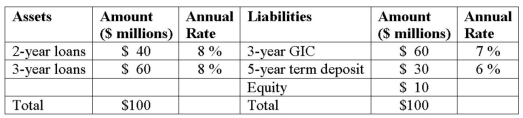

Duration Bank has the following assets and liabilities as of year-end. All assets and liabilities are currently priced at par and pay interest annually.  What is the change in the value of its liabilities if all interest rates decrease by 1 percent?

What is the change in the value of its liabilities if all interest rates decrease by 1 percent?

A) Approximately $2.003 million.

B) Approximately -$2.355 million.

C) Approximately $2.697 million.

D) Approximately $2.906 million.

E) Approximately $3.211 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: An FI finances a $250,000 2-year fixed-rate

Q32: When repricing all interest-sensitive assets and all

Q40: The market value of a fixed-rate liability

Q53: The term structure of interest rates assumes

Q55: The following is the balance sheet of

Q57: A bank with a negative repricing (or

Q57: Duration Bank has the following assets and

Q58: The average maturity of the liabilities of

Q93: Which of the following observations about the

Q98: In the repricing gap model, assets or