Essay

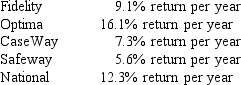

Bob and Dora Sweet wish to start investing $1,000 each month. The Sweets are looking at five investment plans and wish to maximize their expected return each month. Assume interest rates remain fixed and once their investment plan is selected they do not change their mind. The investment plans offered are:

Since Optima and National are riskier, the Sweets want a limit of 30% per month of their total investments placed in these two investments. Since Safeway and Fidelity are low risk, they want at least 40% of their investment total placed in these investments.

Formulate the LP model for this problem.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: A company uses 4 pounds of

Q8: The following linear programming problem has been

Q10: The following linear programming problem has been

Q14: A production optimization problem has 4

Q15: Solve the following LP problem graphically using

Q16: A production optimization problem has 4

Q17: The following diagram shows the constraints for

Q26: The symbols X<sub>1</sub>, Z<sub>1</sub>, Dog are all

Q54: A manager has only 200 tons of

Q64: If there is no way to simultaneously