Multiple Choice

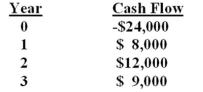

An investment has the following cash flows. Should the project be accepted if it has been assigned a required return of 9.5%? Why or why not?

A) yes; because the IRR exceeds the required return by about 0.39%.

B) yes; because the IRR is less than the required return by about 3.9%.

C) yes; because the IRR is positive.

D) no; because the IRR exceeds the required return by about 3.9%.

E) no; because the IRR is 9.89%.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: The internal rate of return (IRR): I.

Q17: A project has an initial cost of

Q18: Which one of the following is the

Q19: A project will have more than one

Q20: An investment is acceptable if its IRR:<br>A)

Q22: An investment cost $12,000 with expected cash

Q23: You are analyzing two mutually exclusive projects

Q24: What is the net present value of

Q25: A mutually exclusive project is a project

Q26: Analysis using the profitability index:<br>A) frequently conflicts