Multiple Choice

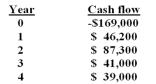

You are analyzing a project and have prepared the following data:  Required payback period 2.5 years

Required payback period 2.5 years

Required return 8.50%

Based on the internal rate of return of _______ for this project,you should _______ the project.

A) 8.95%; accept

B) 10.75%; accept

C) 8.44%; reject

D) 9.67%; reject

E) 10.33%; reject

Correct Answer:

Verified

Correct Answer:

Verified

Q95: Accepting positive NPV projects benefits the stockholders

Q96: A project has an initial cost of

Q97: The Camel Company is considering two mutually

Q98: An investment with an initial cost of

Q99: What is the net present value of

Q100: Consider an investment with an initial cost

Q101: You would like to invest in the

Q102: The two fatal flaws of the internal

Q104: When the present value of the cash

Q105: You are considering a project with the