Multiple Choice

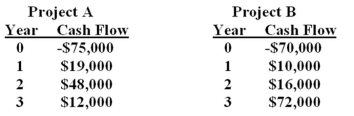

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.  Required rate of return 10% 13%

Required rate of return 10% 13%

Required payback period 2.0 years 2.0 years

Based on the net present value method of analysis and given the information in the problem,you should:

A) accept both project A and project B.

B) accept project A and reject project B.

C) accept project B and reject project A.

D) reject both project A and project B.

E) accept whichever one you want as they represent equal opportunities.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: The payback period rule:<br>A) determines a cutoff

Q35: Modified internal rate of return:<br>A) handles the

Q36: The Walker Landscaping Company can purchase a

Q37: In actual practice,managers may use the: I.

Q38: The difference between the present value of

Q40: If a project has a net present

Q41: If there is a conflict between mutually

Q42: Which one of the following statements concerning

Q43: You are considering the following two mutually

Q44: A $25 investment produces $27.50 at the