Multiple Choice

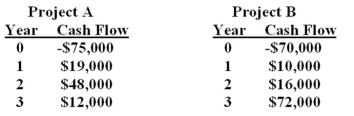

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.  Required rate of return 10% 13%

Required rate of return 10% 13%

Required payback period 2.0 years 2.0 years

Based upon the profitability index (PI) and the information provided in the problem,you should:

A) accept both project A and project B.

B) accept project A and reject project B.

C) accept project B and reject project A.

D) reject both project A and project B.

E) disregard the PI method in this case.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: The difference between the present value of

Q39: You are considering the following two mutually

Q40: If a project has a net present

Q41: If there is a conflict between mutually

Q42: Which one of the following statements concerning

Q44: A $25 investment produces $27.50 at the

Q45: Which one of the following statements is

Q46: You are considering two independent projects both

Q47: It will cost $3,000 to acquire a

Q48: Matt is analyzing two mutually exclusive projects