Multiple Choice

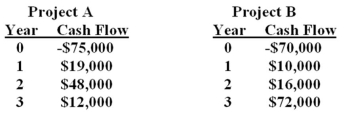

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.  Required rate of return 10% 13%

Required rate of return 10% 13%

Required payback period 2.0 years 2.0 years

Based upon the payback period and the information provided in the problem,you should:

A) accept both project A and project B.

B) reject both project A and project B.

C) accept project A and reject project B.

D) accept project B and reject project A.

E) require that management extend the payback period for project A since it has a higher initial cost.

Correct Answer:

Verified

Correct Answer:

Verified

Q59: Discuss how frequently publicly traded firms use

Q60: The payback period rule:<br>A) discounts cash flows.<br>B)

Q61: You are considering two independent projects with

Q62: What is the profitability index for an

Q63: List and briefly discuss the advantages and

Q65: The advantages of the payback method of

Q66: Given the goal of maximization of firm

Q67: An investment is acceptable if the profitability

Q68: If you want to review a project

Q69: Graphing the NPVs of mutually exclusive projects