Multiple Choice

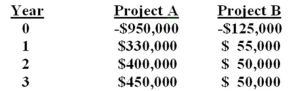

You are considering two independent projects with the following cash flows. The required return for both projects is 10%. Given this information,which one of the following statements is correct?

A) You should accept project B since it has the higher IRR and reject project A because you can not accept both projects.

B) You should accept project A because it has the lower NPV and reject project B.

C) You should accept project A because it has the higher NPV and you can not accept both projects.

D) You should accept project B because it has the higher IRR and reject project A.

E) You should accept both projects if the funds are available to do so since both NPV's are > 0.

Correct Answer:

Verified

Correct Answer:

Verified

Q56: The elements that cause problems with the

Q57: An investment project has the cash flow

Q58: Given that the net present value (NPV)

Q59: Discuss how frequently publicly traded firms use

Q60: The payback period rule:<br>A) discounts cash flows.<br>B)

Q62: What is the profitability index for an

Q63: List and briefly discuss the advantages and

Q64: You are considering the following two mutually

Q65: The advantages of the payback method of

Q66: Given the goal of maximization of firm