Your Company Is Choosing Between the Following Non-Repeatable,equally Risky,mutually Exclusive

Multiple Choice

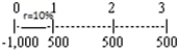

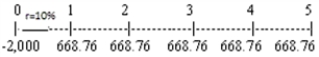

Your company is choosing between the following non-repeatable,equally risky,mutually exclusive projects with the cash flows shown below.Your required rate of return is 10 percent.How much value will your firm sacrifice if it selects the project with the higher IRR?

Project S:  Project L:

Project L:

A) $243.43

B) $291.70

C) $332.50

D) $481.15

E) $535.13

Correct Answer:

Verified

Correct Answer:

Verified

Q18: A particular project might have very uncertain

Q23: Which of the following statements is correct?<br>A)

Q24: The change in net working capital is

Q25: A company is analyzing two mutually exclusive

Q28: The capital budgeting director of Sparrow Corporation

Q29: Carolina Insurance Company,an all-equity life insurance firm,is

Q31: Which of the following statements is correct?<br>A)

Q32: An investment project has an initial cost,and

Q49: Scott Corporation's new project calls for an

Q69: With the current techniques available, estimating cash