Multiple Choice

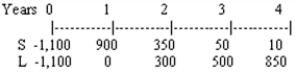

A company is analyzing two mutually exclusive projects,S and L,whose cash flows are shown below:  The company's required rate of return is 12 percent.What is the IRR of the better project? (Hint: Note that the better project may or may not be the one with the higher IRR. )

The company's required rate of return is 12 percent.What is the IRR of the better project? (Hint: Note that the better project may or may not be the one with the higher IRR. )

A) 13.09%

B) 12.00%

C) 17.46%

D) 13.88%

E) 12.53%

Correct Answer:

Verified

Correct Answer:

Verified

Q18: A particular project might have very uncertain

Q20: Your company is considering a machine that

Q21: Given two mutually exclusive projects and a

Q23: Which of the following statements is correct?<br>A)

Q24: The change in net working capital is

Q27: Your company is choosing between the following

Q28: The capital budgeting director of Sparrow Corporation

Q29: Carolina Insurance Company,an all-equity life insurance firm,is

Q49: Scott Corporation's new project calls for an

Q69: With the current techniques available, estimating cash