Multiple Choice

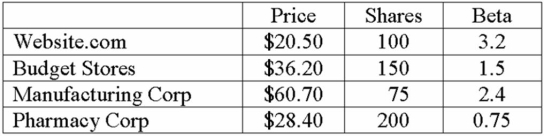

Portfolio Beta and Required Return You hold the positions in the table below. What is the beta of your portfolio? If you expect the market to earn 14 percent and the risk-free rate is 5 percent, what is the required return of the portfolio?

A) 20.21%

B) 22.66%

C) 28.66%

D) 32.48%

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Which of the following statements is incorrect?<br>A)The

Q11: Which of the following is a true

Q14: The constant growth model requires what information

Q27: This is data that includes past stock

Q31: The stocks of small companies that are

Q33: Portfolio Beta You hold the positions in

Q34: Universal Forest's current stock price is $154.00

Q35: You hold the positions in the table

Q36: A measure of the sensitivity of a

Q51: Which of these is the measurement of