Multiple Choice

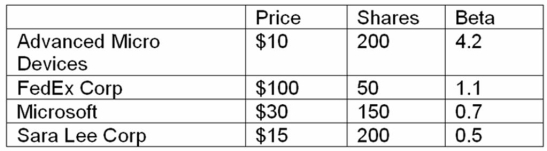

You hold the positions in the table below. What is the beta of your portfolio? If you expect the market to earn 10 percent and the risk-free rate is 4 percent, what is the required return of the portfolio?

A) 12.37%

B) 9.73%

C) 10.17%

D) 11.68%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Which of the following statements is incorrect?<br>A)The

Q19: Which of the following is most correct?<br>A)In

Q31: The stocks of small companies that are

Q32: Portfolio Beta and Required Return You hold

Q33: Portfolio Beta You hold the positions in

Q34: Universal Forest's current stock price is $154.00

Q36: A measure of the sensitivity of a

Q39: Risk Premium The annual return on the

Q40: Expected Return Compute the expected return given

Q51: Which of these is the measurement of