Multiple Choice

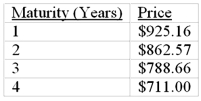

The following is a list of prices for zero-coupon bonds with different maturities and par value of $1,000.  What is, according to the expectations theory, the expected forward rate in the third year

What is, according to the expectations theory, the expected forward rate in the third year

A) 7.23%

B) 9.37%

C) 9.00%

D) 10.9%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: The following is a list of prices

Q3: Suppose that all investors expect that interest

Q4: The "break-even" interest rate for year n

Q6: Term Structure of Interest Rates is the

Q7: If the value of a Treasury bond

Q8: When computing yield to maturity, the implicit

Q9: Explain what the following terms mean: spot

Q10: Suppose that all investors expect that interest

Q11: _ can occur if _.<br>A)arbitrage; the law

Q44: The on the run yield curve is<br>A)