Multiple Choice

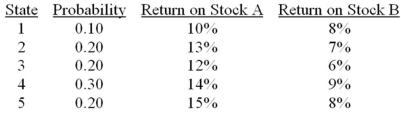

Consider the following probability distribution for stocks A and B:  The expected rates of return of stocks A and B are _____ and _____, respectively.

The expected rates of return of stocks A and B are _____ and _____, respectively.

A) 13.2%; 9%

B) 14%; 10%

C) 13.2%; 7.7%

D) 7.7%; 13.2%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: The separation property refers to the conclusion

Q19: Consider the following probability distribution for stocks

Q20: Which one of the following portfolios cannot

Q22: Discuss how the investor can use the

Q23: The expected return of a portfolio of

Q24: Diversifiable risk is also referred to as<br>A)systematic

Q26: Given an optimal risky portfolio with expected

Q57: Consider an investment opportunity set formed with

Q63: In words, the covariance considers the probability

Q79: Security X has expected return of 9%