Multiple Choice

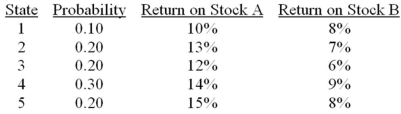

Consider the following probability distribution for stocks A and B:  The expected rate of return and standard deviation of the global minimum variance portfolio, G, are __________ and __________, respectively.

The expected rate of return and standard deviation of the global minimum variance portfolio, G, are __________ and __________, respectively.

A) 10.07%; 1.05%

B) 8.97%; 2.03%

C) 10.07%; 3.01%

D) 8.97%; 1.05%

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The separation property refers to the conclusion

Q15: Consider the following probability distribution for stocks

Q20: Which one of the following portfolios cannot

Q21: Consider the following probability distribution for stocks

Q22: Discuss how the investor can use the

Q23: The expected return of a portfolio of

Q24: Diversifiable risk is also referred to as<br>A)systematic

Q57: Consider an investment opportunity set formed with

Q65: Other things equal, diversification is most effective

Q79: Security X has expected return of 9%